Forex Trading Australian Times

Dealing With Income Tax As A Australian Forex Trader Online Forex

Tax Portfolio Reporting Stockbroking Platform Cmc Markets

Tax Portfolio Reporting Stockbroking Platform Cmc Markets

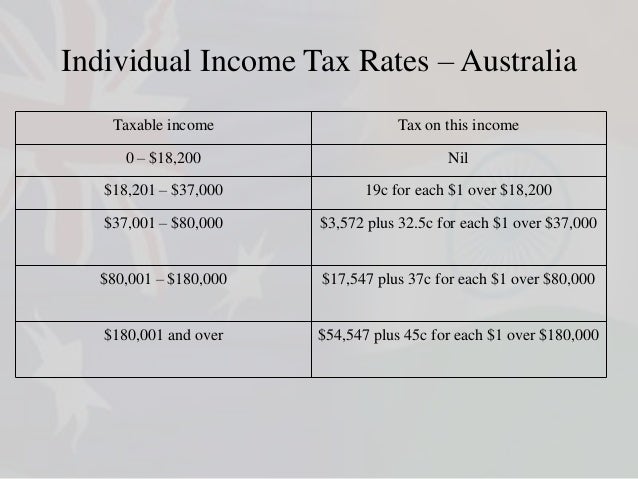

How Forex Trades Are Taxed

How Forex Trades Are Taxed

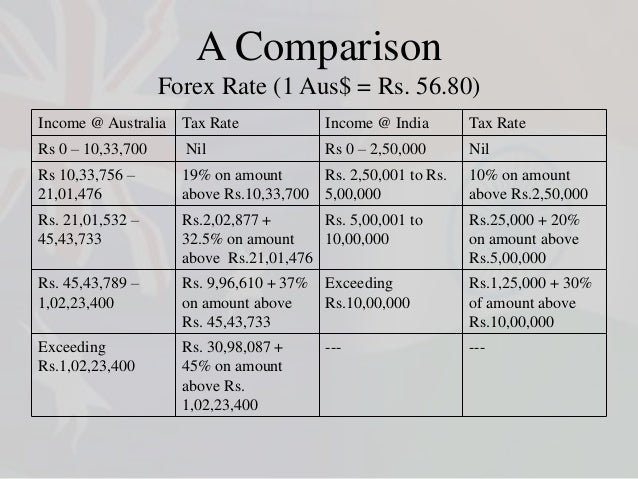

Taxation India Australia

Taxation India Australia

I Total Amount Due Or Refundable Australian Taxation Office

I Total Amount Due Or Refundable Australian Taxation Office

International Stock Trading Fidelity Investments

International Stock Trading Fidelity Investments

An Analysis Of Section 4a Of The Kenyan Income Tax Act Hedging And

An Analysis Of Section 4a Of The Kenyan Income Tax Act Hedging And

Forex Loss Income Tax

How Do You Pay Tax On Skrill Neteller Forex Income How To File

How Do You Pay Tax On Skrill Neteller Forex Income How To File

Australia To Crack Down On Crypto Tax Avoidance Schemes Coindesk

Australia To Crack Down On Crypto Tax Avoidance Schemes Coindesk

Indian Customs Limits For Carrying Cash To From India Indian Rupee

Indian Customs Limits For Carrying Cash To From India Indian Rupee

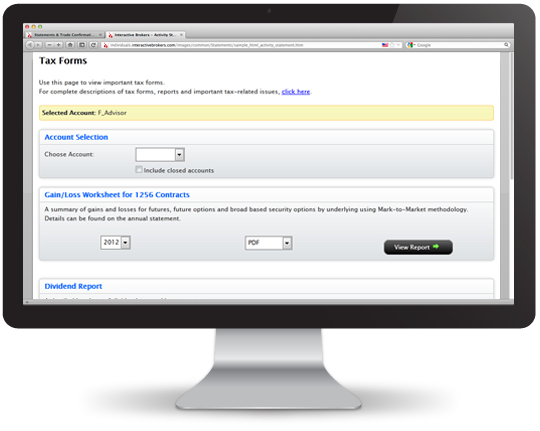

Tax Reporting Interactive Brokers

Tax Reporting Interactive Brokers

Inside Track Superannuation Funds Management Financial Services

Inside Track Superannuation Funds Management Financial Services

Banana Republic Budget Macrobusiness Gold Stocks Forex

Banana Republic Budget Macrobusiness Gold Stocks Forex