This gain or loss then becomes realized income once it is paid or settled. Unrealized gains and losses on foreign exchange.

Foreign Currency Gains And Losses Zuora

Foreign Currency Gains And Losses Zuora

When a company headquartered in one domestic country executes a transaction with a company in another foreign country using a currency other than the domestic currency one currency needs to be converted into another to settle the transaction.

Foreign currency unrealized gain loss. Download from the zuora ui navigate to the foreign currency exchange summary and click download gain loss detail. Unrealized gains and losses that are recorded on unpaid invoices at the end of the month or another accounting period realized gains and losses that are recorded at the time of payment or receipt so youll have to run a currency conversion when you first log the transaction and again at invoice settlement. What is the difference between realized vs.

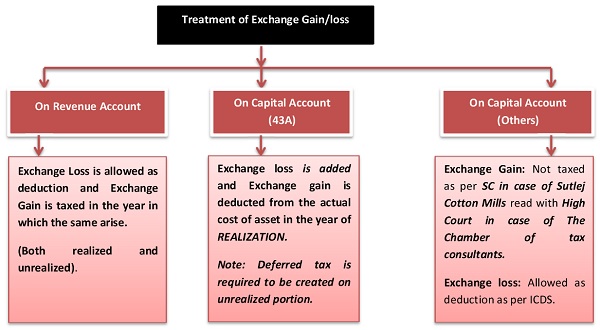

Foreign currency unrealized gain loss. Download from the zuora ui navigate to the foreign currency exchange summary and click download gain loss detail. Unrealized gains and losses that are recorded on unpaid invoices at the end of the month or another accounting period realized gains and losses that are recorded at the time of payment or receipt so youll have to run a currency conversion when you first log the transaction and again at invoice settlement. What is the difference between realized vs. Unrealized gains or losses are the gains or losses that the seller expects to earn when the invoice is settled but the customer fails to pay the invoice by the close of the accounting period. The seller calculates the gains or losses that would have been earned if the customer paid the invoice at the end of the accounting period. In accounting there is a difference between realized and unrealized gains and losses.

! The realized gainloss detail report provides a list of tra! nsactions with their realized foreign currency gains and losses for the accounting period. If the unrealized gainloss report shows a currency gain positive amount for a checking account or another asset account credit the unrealized currency gainloss account and enter an equal debit amount for the exchange account associated with the asset account. Realized income or losses refer to profits or losses from completed transactions.

Foreign currency transactions need to be reported in canadian dollars when they are recorded in the general ledger and on the t2 corporate tax return. Unrealized profit or losses refer to profits or losses that have occurred on paper but the relevant transactions have not been completed. Foreign exchange gain or loss is audited as unrealized income on the balance sheet when it occurs.

Simple Example For Understanding Realized Forex Gain Loss Sap Blogs

Simple Example For Understanding Realized Forex Gain Loss Sap Blogs

How Are Foreign Exchange Gains And Losses Reported Bizfluent

How Are Foreign Exchange Gains And Losses Reported Bizfluent

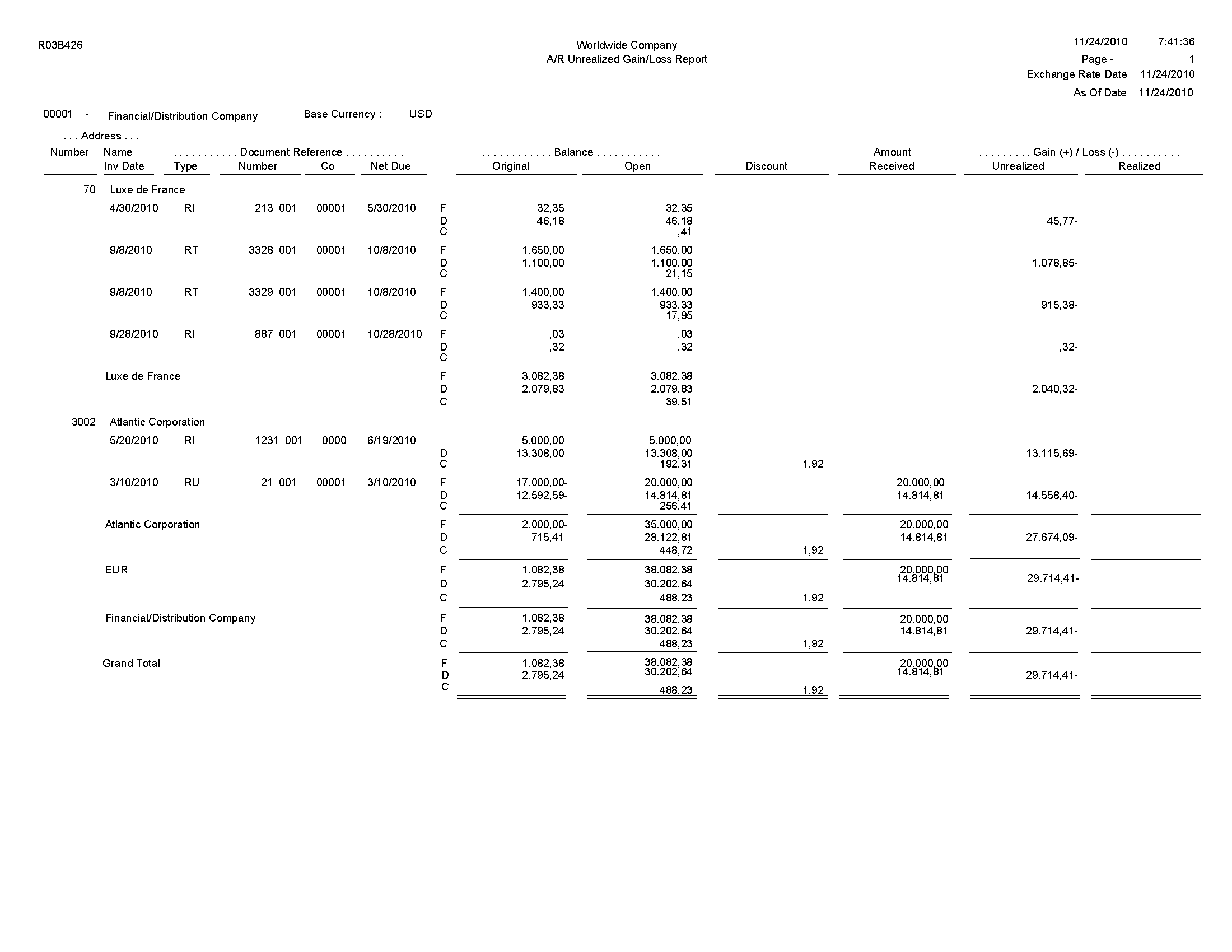

Jd Edwards Enterpr! iseone Accounts Receivable Reports

Jd Edwards Enterpr! iseone Accounts Receivable Reports

Other Comprehensive Income Overview Examples How It Works

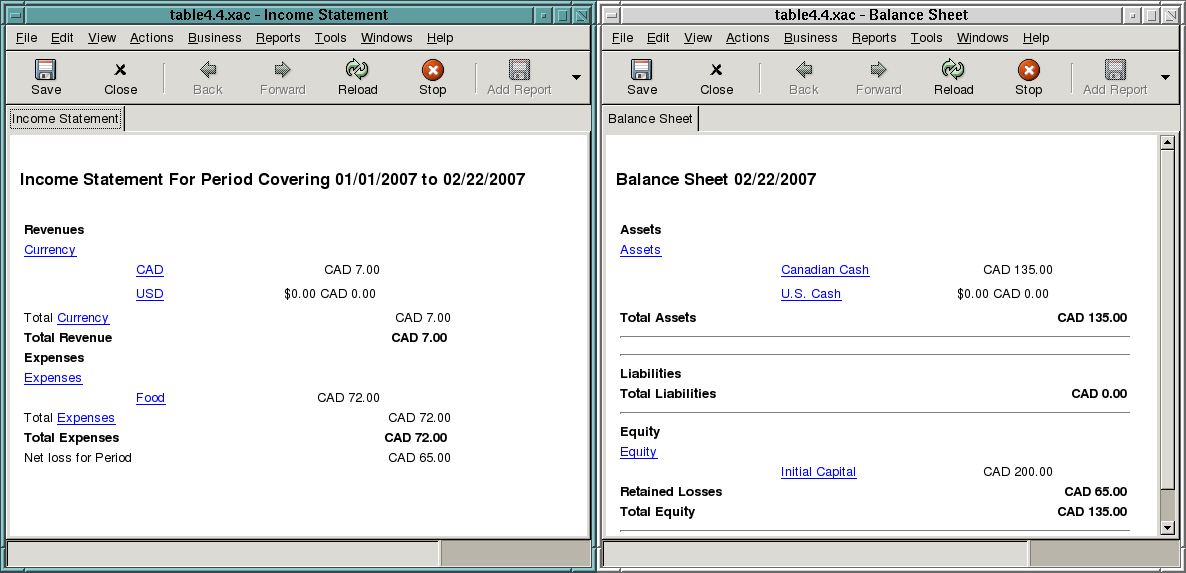

Multiple Currency Accounting In Gnucash

Multiple Currency Accounting In Gnucash

Un! realized Currency Gains Experts In Quickbooks Consulting

Unrealized Gain Loss Postings Dynamics 365 For Finance And

Unrealized Gain Loss Postings Dynamics 365 For Finance And

Oracle Payables User S Guide

Oracle Payables User S Guide

Fagl Fc Val Delta Logic Foreign Currency Valuation Erp Financials

Tuesday S T T Unrealized Gains And Losses Updating Currency

Jd Edwards Enterpriseone Accounts Payable Reports

Jd Edwards Enterpriseone Accounts Payable Reports

Foreign Currency Transactions And Hedging Pdf

Foreign Currency Transactions And Hedging Pdf

Difference Between Realised And Unrealised Foreign Exchange Best

Fx Gain Loss Kantox

Fx Gain Loss Kantox

Gain And Loss Account Define